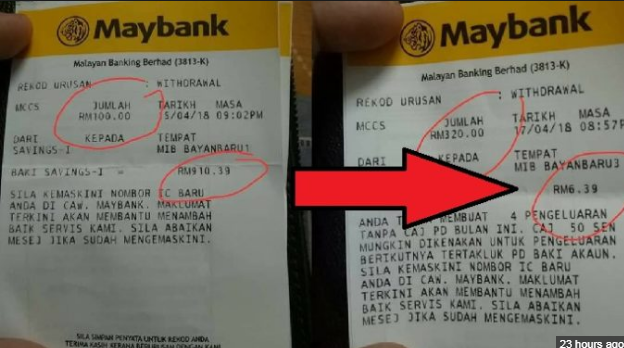

'Astro potong RM84.00 rupanya...'

If you own a caravan, you will without doubt need a specialist caravan insurance policy to cover it, or risk losing what is probably the third largest asset and investment you posses, after a home and car. Caravans are at risk from many perils not least fire and flood, but are also at risk from very different hazards depending on whether the caravan is of touring or static nature. Insurance policies for each type of caravan reflect these risks and each type offers a different underwriting proposition covering specific risks that a caravan might face. Static caravans are often used as temporary buildings when housing alterations are being carried out, but more often as an investment on a holiday park near the sea. One doen't have to look back too far to remember the videos of the devastation caused to caravan parks around the country by extreme weather events such as storms and coastal flooding. Images of static caravans being washed away and picked up by ...